Trade crypto with deep liquidity, advanced charts, stop orders.

CEX.IO Savings

| Coin |

Current Reward %

annual reward percentage

| Flexible Rewards Per Thousand | Auto transfer | |

|---|---|---|---|---|

USDC USDC |

4%

| 3.33 USDC | ||

USDT USDT |

4%

| 3.33 USDT | ||

SOL Solana |

4%

| 3.33 SOL | ||

TRX Tron |

3%

| 2.5 TRX | ||

ADA Cardano |

2%

| 1.67 ADA | ||

EURC EURC |

2%

| 1.67 EURC | ||

BTC Bitcoin |

0.25%

| 0.21 BTC | ||

ETH Ethereum |

2%

| 1.67 ETH | ||

DOGE Dogecoin |

0.1%

| 0.08 DOGE | ||

PEPE Pepe |

0.1%

| 0.08 PEPE | ||

LINK ChainLink |

0.1%

| 0.08 LINK | ||

SHIB Shiba Inu |

0.1%

| 0.08 SHIB | ||

SUI SUI |

0.1%

| 0.08 SUI | ||

UNI Uniswap |

0.1%

| 0.08 UNI | ||

XLM Stellar |

0.1%

| 0.08 XLM | ||

XRP XRP |

0.1%

| 0.08 XRP | ||

BCH Bitcoin Cash |

0.1%

| 0.08 BCH | ||

COMP Compound |

0.1%

| 0.08 COMP | ||

LTC Litecoin |

0.1%

| 0.08 LTC | ||

OP Optimism |

0.1%

| 0.08 OP | ||

DAI Dai |

0.1%

| 0.08 DAI |

CEX.IO Crypto Savings Accounts

In the earliest days of cryptocurrency, people used to invest in this new asset class hoping that its price would skyrocket someday.

Alternatively, you could also make money by trading coins but trading requires a lot of hard work and experience.

Today, cryptocurrency could give you a continuous stream of rewards with crypto savings accounts. CEX.IO offers crypto savings accounts where you earn rewards in return for depositing your crypto holdings. The process is akin to savings accounts in traditional banks, albeit with significantly higher rewards.

What is crypto savings?

Unlike stocks, crypto tokens do not generate cash flows and thus do not pay dividends to their investors. Considering that, cryptocurrencies are more like commodities which means unless a token earns rewards, the value of the token is determined entirely by demand. Although the demand for crypto has grown at an exponential rate during the last decade, there is no guarantee that this highly speculative asset class will keep growing in the future.

Crypto savings ensure that the underlying value of a cryptocurrency continues to grow over time. For example, if you deposit 10,000 USDT to CEX.IO Savings, it will be 10,300 USDT a year later. By earning rewards through a crypto savings account, you could potentially increase the underlying value of your account, regardless of fiat currency price.

What is a crypto savings account?

A crypto savings account is a rewards account offered by a cryptocurrency exchange. It allows you to earn rewards on your cryptocurrency holdings.

Earning rewards from cryptocurrency is becoming more and more common in recent years as investors are looking for alternative places to generate reward due to negligible savings rates in traditional bank accounts.

Although crypto reward accounts function pretty similarly to traditional bank savings accounts, there are some important differences as well:

Higher asset risks

Stablecoins carry regulatory risks, which is why you earn much higher reward on them with a cryptocurrency exchange. After all, it is a virtual representation of the U.S. Dollar without any legal backing or license. In other words, you get those lucrative stablecoin reward in return for this legal risk.

It's not only stablecoins that have regulatory risks; any cryptocurrency is faced with the same risk including Bitcoin and Ethereum. Possible regulations in the future are posing access risks for the cryptocurrency market.

Regulatory risks

The market has been highly fearful of regulations since the inception of this asset class. This situation is often abused to create FUD (fear, uncertainty, and depression) in the market to shake out the weak hands during market sell-offs.

However, regulations are indeed materializing. The Securities and Exchange Commission (SEC) in the U.S. recently banned the crypto reward accounts of several major cryptocurrency platforms.

Please note that CEX.IO crypto savings accounts are currently not available in the U.S.

Higher reward rates

The rates offered on CEX.IO crypto savings accounts are typically higher compared to the fiat-currency reward at banks. This especially includes the U.S. dollar-pegged stablecoins.

On CEX.IO, you could earn up to a whopping 12% reward per annum for stablecoins, which is astronomical considering the average 1% savings reward for the U.S. Dollar.

It is a common practice for investors around the world to convert their fiat U.S. dollars to stablecoins and benefit from the high reward offered on cryptocurrency exchanges. CEX.IO offers the highest reward for the Tether (USDT) stablecoin at 12% if you use a Locked Savings rewards account , which blocks your funds for a period of your choice (30, 60, 90 days).

This mechanism is similar to a traditional time deposit, like a CD, where you lock up your funds in return for a higher reward. If you would generally prefer the highest reward rates possible, you can also opt for CEX.IO Staking.

Other than stablecoins, you can earn 4% yearly reward for Bitcoin and 6% for Ethereum on a CEX.IO crypto savings account.

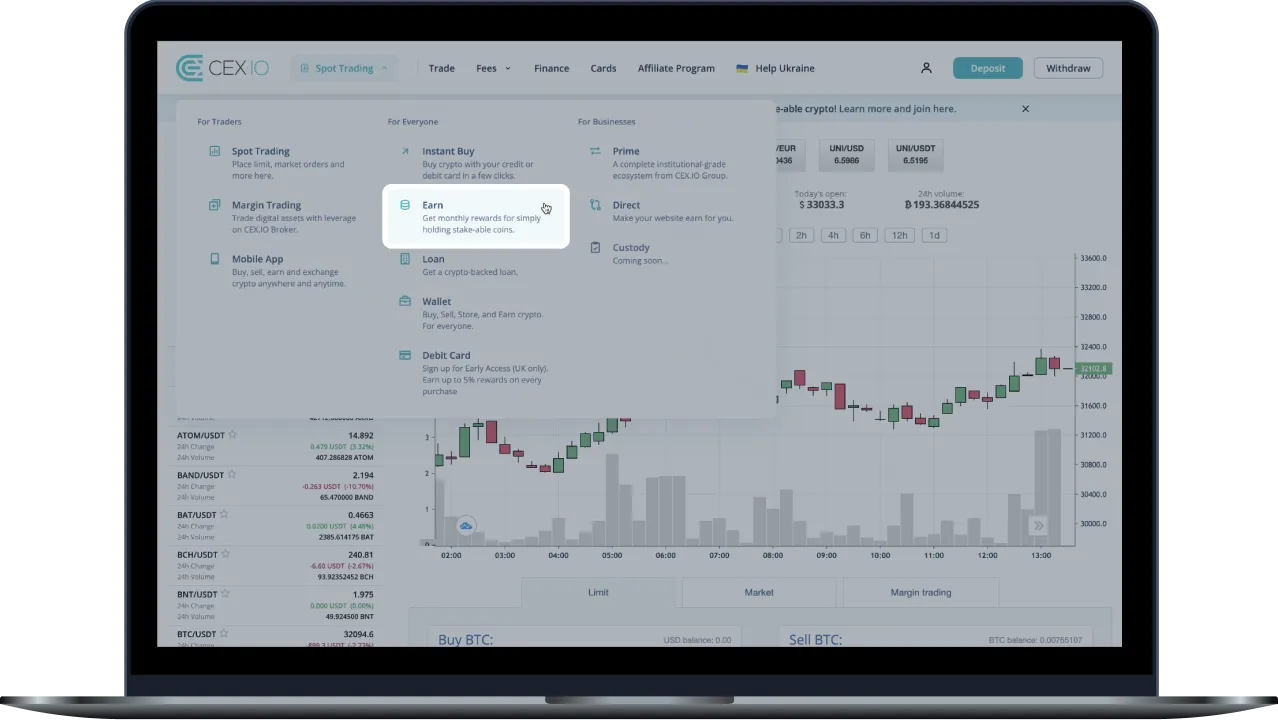

- 1Flexible SavingsThese accounts are located under CEX.IO Savings. To go to CEX.IO Savings, click on the Spot Trading button on the top left corner of your homepage, right next to the CEX.IO logo. In the dropdown menu that pops out, click on Earn under the For Everyone list:

- 2Locked Savings

Locked Savings

A Locked Savings account on the other hand locks your coins for a specific period just like a traditional time deposit account, like a CD. This means you cannot remove your funds from the savings wallet until maturity. There are three available lockup maturity periods – 30, 60, or 90 days.

Once you transfer funds from your CEX.IO exchange wallet to a Locked Savings wallet, you cannot go back and remove your funds until the unlock date, but in return, you are rewarded with much higher reward. For example, with Locked Savings, you could be able to earn 12% annual reward rate for the Tether stablecoin, compared to 3% with Flexible Savings.

Funds you transfer to a Locked Savings account are deposited to a locked savings wallet from your exchange wallet, and your reward payouts are disbursed to this locked wallet. You receive your reward payout on the unlock date.

Currently, there are three available lock periods on CEX.IO Savings – 30, 60, or 90 days. Your accrued reward is credited to your savings wallet at the end of the lock period.

During the lock period, you can monitor your accrued rewards by clicking on the "Earned" column on the Savings page. The information is updated every day at 6:00 am UTC.

Best rewarded flexible savings accounts

CEX.IO Savings is the best place to earn rewards on crypto. With flexible savings accounts, you earn a highly competitive rate of 3% annual rewards percentage for your stablecoins, compared to an average of 1% rewards on traditional USD savings accounts. Stablecoins on which you can earn rewards with CEX.IO include Tether (USDT), USD Coin (USDC), TrueUSD (TUSD), and DAI.

Flexible Savings

A Flexible Savings account on CEX.IO does not lock your funds so you can withdraw or sell the tokens in your savings wallet any time you like.

However, you should note that if you move funds out of your Flexible Savings account, you will not be able to receive full rewards for the payout period.

Reward payouts in Flexible Savings accounts are credited daily to your savings wallet.

Cryptocurrency tokens that you transfer to a Flexible Savings account remain in an unlocked savings wallet,where your reward payouts are also credited.

You can withdraw or sell the cryptocurrency tokens that you have initially transferred any time you like, in addition to the reward payments thus far.

When you withdraw or sell funds, the system starts with your earned rewards. If you want to transfer out a larger amount than your accrued rewards, then it withdraws or sells from your principal amount as well.

Highest crypto reward rates with locked savings accounts

If you don't need the cash flow from daily flexible savings payouts, you can receive better rates with our locked savings product. CEX.IO offers the highest reward for its USDT locked savings account at 12%.

Lucrative rates with locked savings do not end with stablecoins. CEX.IO offers the highest reward rates in the industry for both Bitcoin and Ethereum, at 4% and 6% respectively.

How do I transfer funds to CEX.IO Savings?

On the CEX.IO Savings page, click on the green Transfer button to the right of the cryptocurrency logo that you want to deposit.

CEX.IO offers an auto-transfer function that continues transferring the available balance on your exchange wallet for that cryptocurrency, to your savings wallet. If you activate auto-transfer and then make a new deposit, that deposit will automatically be transferred to your savings wallet at the end of each day.

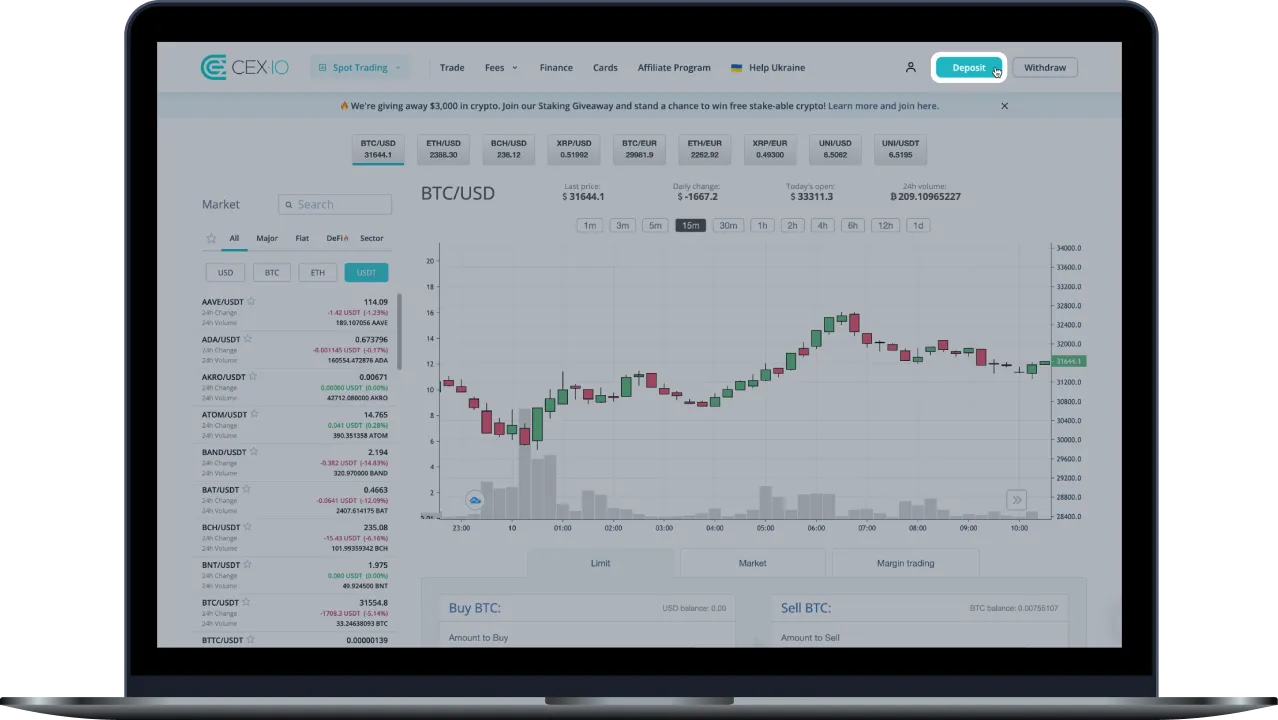

- 1Go to the Deposit pageClick on the green Deposit button at the right top corner of your CEX.IO homepage,

- 2Select the currency menu

- 3Select an asset

- 4Transfer funds to the wallet

- 1Go to the Buy/Sell pageClick the Products menu right next to the CEX.IO logo. In the dropdown menu that pops out, click on

- 2Choose a crypto to purchase

- 3Choose the purchase amount

- 4Confirm the transaction

How it works

FAQ

What is CEX.IO Savings?

What assets participate in CEX.IO Savings?

Do you charge any fees for Savings services?

Do I need to lock my funds in the Savings account?

What are Flexible Savings?

Does CEX.IO provide Locked Savings?

How do I get started with CEX.IO Savings?

To start saving automatically, activate the auto slider. Once you buy or deposit assets, they will be automatically transferred to your savings account.

Are there any transaction fees for sending funds to and from the CEX.IO Savings account?

When do I start earning potential rewards with CEX.IO Savings?

When will I receive my Savings rewards?

Where can I see how much reward I earn?

How often do I receive rewards from a Flexible Savings product?

Is my reward redeemed automatically?

How do I redeem funds from my Savings account?

When can I redeem my funds?

There're two options for doing so — standard redemption (Standard redeem), and fast redemption (Fast redeem). The former holds funds until the end of the period for accruing daily rewards. The latter allows users to redeem their funds instantly, but they will not earn rewards on the redemption day.

What is "fast redeem?"

What is "standard redeem?"

Can I earn the potential reward during a crypto market decline?

How do you calculate rewards on crypto savings?

In which countries do you operate?

How is CEX.IO Savings different from CEX.IO Staking?

Is there a minimum balance required to start earning rewards on CEX.IO Savings?

Is there a maximum limit of crypto that can be saved on CEX.IO?

Can my Savings balance drop in value?

Please be aware of the risks involved with any trading or savings done in any cryptocurrency market due to its high volatility. Please familiarize yourself with the full Savings terms before deciding to participate in the Savings process.

Please be aware of the risks involved with any trading or staking done in any cryptocurrency market due to its high volatility. Please familiarize yourself with the full staking terms of each applicable Staking coin provider before deciding to participate in the Staking process.

To use our services - including buying, selling, and storing crypto - we need to verify your identity. This helps keep your account secure and compliant with regulations.